Bank of America provides $7.8B to create 12,600 housing units to help seniors, formerly homeless

New England Council member, Bank of America, reported that the company’s Community Development Banking (CDB) branch provided $7.8 billion in debt and equity financing in 2024 to help create and preserve 12,600 housing units for individuals, families, seniors, veterans, the formerly homeless, and those with special needs.

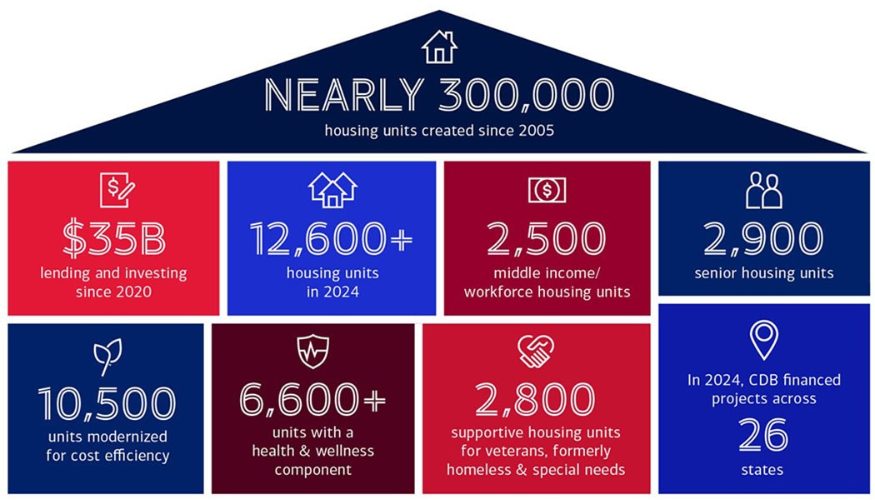

CDB financing has resulted in nearly 300,000 housing units created since 2005; $35 billion in lending and investing since 2020; 12,600+ housing units in 2024; 2,500 middle income/workforce housing units; 2,900 senior housing units; 10,500 units modernized for cost efficiency; 6,600 units with a health & wellness component; 2,800 supportive housing units for veterans, formerly homeless & special needs. In all, CDB reported financed projects across 26 states. Bank of America also reported that its banking and markets businesses provided an additional $325 million in financing that supports multifamily affordable housing over the course of 2024.

“For over 30 years, Bank of America has helped clients build communities that provide the best outcomes for residents … Affordable housing changes lives, whether for the most vulnerable seniors or the unhoused, as well as middle-income families. With a focus on developments that provide supportive services and access to healthcare and sustainability, we remain steadfast in our commitment to advising clients and providing solutions to support the communities where we live and work,” said Maria Barry, National Executive of Community Development Banking at Bank of America.

The New England Council commends Bank of America for this venture to reinvest in our communities.

Read more in the press release from Bank of America and in the Providence Business Journal.